Unraveling the Mystery: What Factors Drive Your Credit Score?

Understanding Your Credit Score: A Simple Guide

If you’ve ever wondered how your credit score is calculated and why it’s important, then this guide is for you! Your credit score is a number that’s as mysterious as it is crucial. So, what does it represent and how is it figured out?

Let’s demystify this subject. While there are numerous types of credit scores, you don’t need to worry about all of them. The most commonly used one is the FICO score, created in 1989 by Fair Isaac Corporation. Another one you might hear of often is the VantageScore, a joint venture by the big three credit bureaus: Experian, Equifax, and TransUnion.

Both FICO scores and VantageScores range from 300 to 850 – the higher, the better. Each credit bureau assigns its own score, based on the reported data they have about your payment history. Since not every lender or creditor reports to all three bureaus, your score may vary between them.

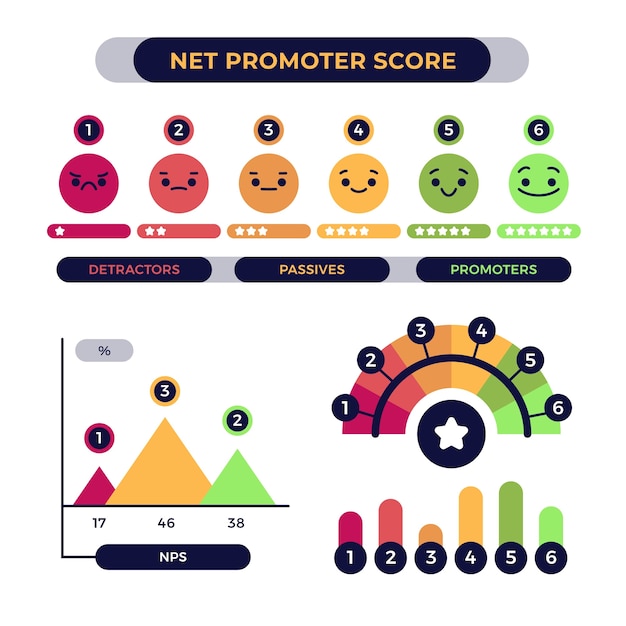

Now, what influences your credit score? Well, details like the amount owed, length of your credit history, new credit, and types of credit or credit mix, all play their part. Along with these, payment history is the most significant factor.

Keeping a sharp eye on your credit score and ensuring timely bill payments will help boost your financial well-being.

Why is a good credit score important, you ask? A lot is at stake. A poor credit score can lead to loan and rental application rejections, high-interest rates, and even job losses. On the flip side, a good score means you can borrow money at better rates, influencing how much you end up paying for things like a house or car.

Your FICO score is calculated by crunching data from your credit report through a proprietary algorithm with five main factors:

– Payment history: 35%

– Amount owed: 30%

– Length of credit history: 15%

– New credit: 10%

– Types of credit: 10%

These factors give an overall picture of your financial responsibility. For instance, a higher credit utilization ratio (how much of your available credit you’re using) can lead to a lower score, as it might indicate you’re at risk of defaulting. Being smart about your credit – like not opening too many new accounts in a short period or maintaining a healthy mix of debt types – can boost your score.

Remember, when companies check your credit – for a loan application, for example – it can slightly lower your score (this is known as a hard inquiry), while checks you make yourself (soft inquiries) don’t impact your score.

Generally speaking, you’ll need at least one account reported to the credit bureau in the past six months to have a credit score, which is vital to get approval for most types of loans and credits.

While your credit score can be influencer, lenders might also consider your income, employment history, and status for plotting your financial prospects.

As for understanding your score, here is a handy guide:

– 800-850: Exceptional

– 740-799: Very good

– 670-739: Good

– 580-669: Fair

– 300-579: Very poor

To get your credit score, you can request it from some credit card companies or use services like Credit Karma. AnnualCreditReport.com lets you access your credit report from each major bureau once a year, but not the score.

Finally, even if the report doesn’t give you the score, verify everything on it is accurate once a year. If you find inaccuracies or accounts that aren’t yours, report them to the credit bureau.