Is it Possible to Short Stocks using Webull?

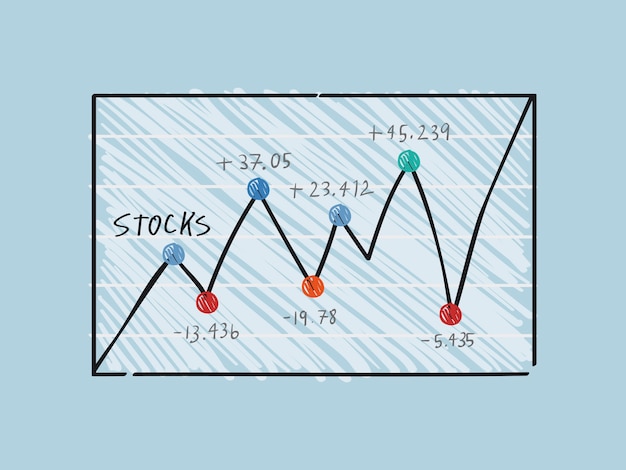

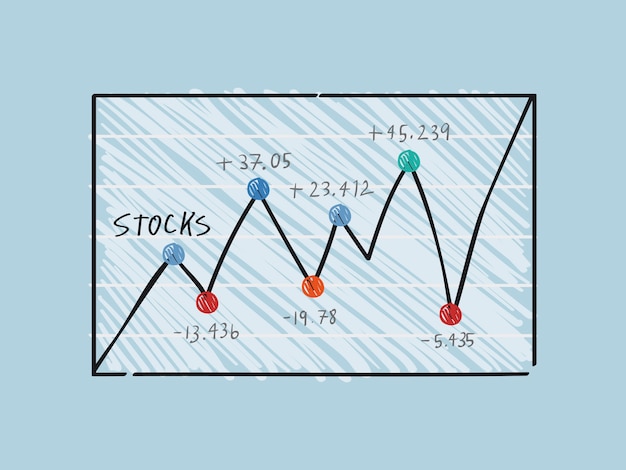

Thinking of ways to grow your money? If you’ve got surplus income, you might consider investing. But how about a strategy that’s the opposite of buy-low-sell-high? This is called short selling stocks, where you bet that a company’s stock value will go down, not up.

This method is risky. You’d be wagering on a stock’s value to decrease. The possible gains are capped, as the lowest a stock can go is $0, but the potential for losses is unlimited because a stock’s price can keep rising indefinitely.

Various online trading platforms allow short selling, including stocks, index funds, and other assets. We’ll delve into this a bit more, focusing on Webull, to help you decide if this path is right for you.

What is Short Selling?

It might sound complex, but it’s essentially betting that a stock’s price will drop. An investor borrows shares of a stock, sells them hoping the price will fall, and then eventually buys them back at a lower price to return to the lender. Some traders choose to do this as a way to hedge against risks and soften the blow of losses that could result from other investments.

The Risks of Short Selling

Remember, there’s potential for making serious money through short selling, but it’s not for the faint-hearted.

First, there’s unlimited risk. If you buy a stock, the most you could lose is 100% of your investment if the company goes bust. But if you short a stock and its price skyrockets, you could lose much more than your original investment.

Secondly, too much short selling can trigger a market slump. Large-scale sell-offs can deflate the value of companies or assets beyond what’s natural. Some even blame short selling for the 2008 financial crisis.

If you’re still keen on short selling, you should do thorough research, monitor your position closely, and be ready to buy back the stock once it falls to the levels you’re aiming for.

Short Selling on Webull

Webull allows short selling but there are requirements that traders must meet first. You need a Webull margin account with a net value of at least $2,000. There are strategies available for exploiting the decline in an asset’s price.

To short a stock on Webull, you would borrow the shares from an investor via the Webull platform, sell the borrowed shares at the current market price, then buy back those shares at a lower price to return to the lender. This process is simplified to several steps on the Webull app.

Be aware that there are fees involved in short selling on Webull. The costs involve the borrowing fee you pay for the stock in the margin account, which is subject to daily variations.

In Conclusion

Short selling stocks on Webull or similar platforms can be a powerful strategy when the conditions are right. There’s fast money to be made, especially in a bear market. But this method is high-risk and can quickly turn against you. It’s not advised for beginners or those who can’t afford to lose money.